Banks today have a unique opportunity to elevate the productivity of their software engineering teams. By doing so, banks can boost technology speed and productivity without needing larger IT budgets.

Technology has transformed the banking sector. Traditional banks have expanded their tech teams, who now play a crucial role in creating innovative products. These products include AI-powered personalized experiences for customers, streamlined digital payment options, and analytics-driven cross-selling opportunities. Bank tech teams are also integrating acquisitions, automating back-office tasks, and handling vast data securely. Reviewing a bank’s strategy often reveals that most key initiatives are heavily reliant on technology.

However, many banks struggle to invest fully in tech innovation. Budgets are tight, and as technology ages and becomes more complex, the costs to maintain it increase. Many banks have already tried traditional methods like outsourcing or renegotiating vendor contracts to cut costs. Now, they are in search of new ways to create budget flexibility.

Some forward-thinking banks are taking a different approach by concentrating on increasing their tech team’s productivity instead of merely cutting costs. Inspired by the practices of digital-native software companies, they focus on maximizing the time their tech staff spends writing code, then helping these engineers work as effectively as possible. This developer-focused approach is common in the tech industry, but it is still relatively new for most banks. Banks that have adopted this strategy, however, are already seeing positive results. The most productive banks achieve around 50% more technology capacity—measured by the hours teams can dedicate to innovation—than their peers without raising their budgets. They’re also able to release new features for customers faster and attract skilled engineers who bring valuable practices to the organization, forming a cycle that further boosts productivity.

This article explores how this productivity-first approach works, identifies key strategies that yield the best results, and offers actions for leadership teams to get started.

Maximizing Technology Investments

In many banks, spending on technology—whether for talent, hardware, software, or services—is often the biggest expense. Yet, technology spending is sometimes seen as a “black box.” While banks can track how much they invest and whether projects are completed on time, they often have limited insight into the productivity of their tech teams or whether improvements in efficiency could be beneficial.

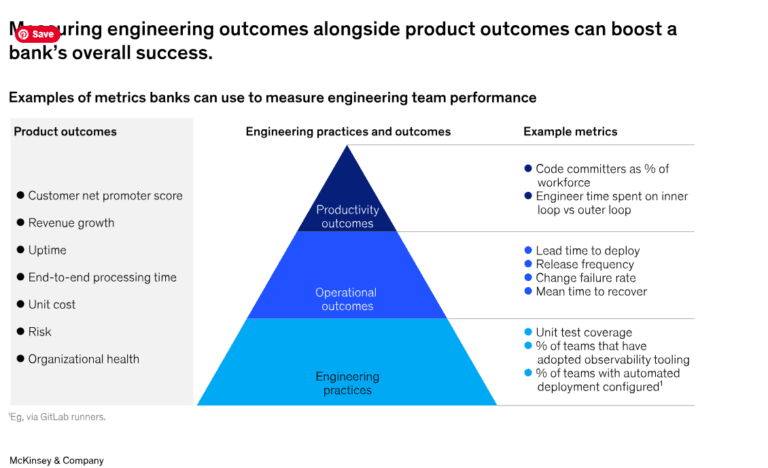

In recent years, some leading banks have begun using scorecards to evaluate their engineering teams’ speed and productivity. They analyze data from the tools their teams use, allowing them to spot areas where both speed and quality can improve and where they can better support creativity within their teams. By enabling their engineering teams to work smarter, these banks have significantly increased their technology capacity compared to average banks—all without increasing budgets.

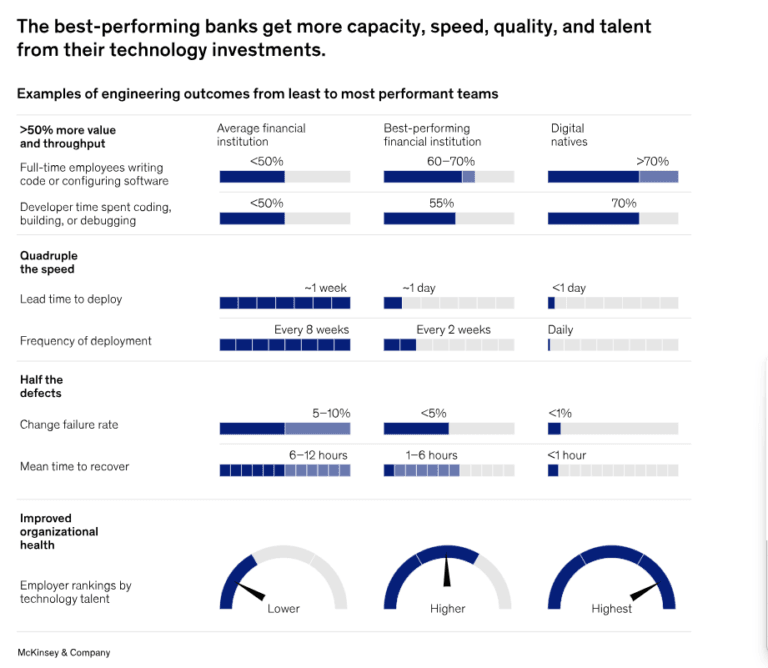

Let’s compare an average bank with a top-performing one. At a typical bank, only half of the technology staff is engaged in creating software, and those employees spend about half their time on essential tasks like writing, testing, and maintaining code. This means only about 25% of the bank’s technology resources are focused on actual software development. The remaining 75% of the work involves tasks like coordination and analysis that, while important, could be streamlined or automated. In contrast, leading banks have about 70% of their technology workforce involved in coding or maintaining code, with these employees dedicating 55% of their time to core activities. As a result, top banks allocate 39% of their technology resources to software development—roughly 50% more than an average bank.

The productivity of high-performing engineering teams also translates into faster delivery of new features, fewer bugs, and higher-quality products. They create solutions that better meet business and customer needs, leading to improved user experiences, stronger customer retention, and revenue growth.

Four Strategies to Transform Engineering Productivity

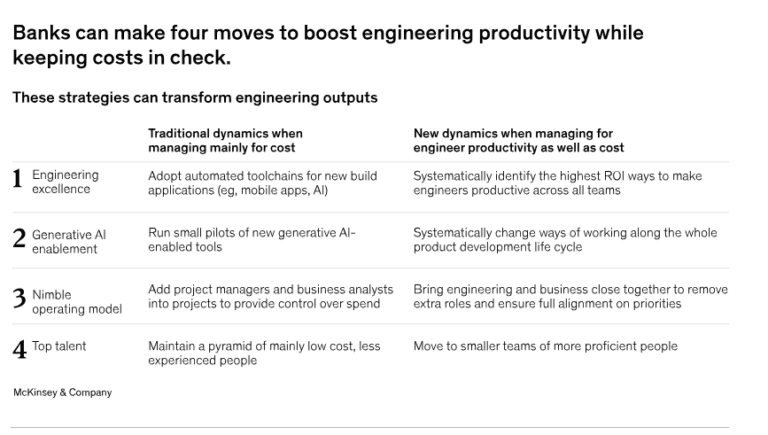

Focusing on engineering productivity rather than just costs can shift how management views technology spending. Leaders begin to ask what actions will meaningfully improve productivity, assess the ROI of different approaches, and explore how to create a cycle where a better environment attracts top engineers.

To increase productivity, bank leaders can adopt four key strategies:

1. Optimize the Software Development Life Cycle

Executives are sometimes surprised by the manual work involved when tech teams create software. At one major bank, for instance, a developer needed approvals from multiple teams just to set up an environment before writing code. After coding, extensive manual testing was required because automated tests covered only a few cases. Additional security checks were needed from teams available only during certain weeks, and the final deployment required multiple approvals. Instead of streamlining this process, the bank had hired more managers and testers, adding to both costs and complexity.

A leading financial institution avoided this trap by conducting a detailed assessment, or “X-ray,” of its engineering teams to understand their practices and performance. This data-driven approach helped management spot the initiatives that could drive the biggest productivity gains. They then updated their engineering tools, automated security controls, and created a coaching team to guide engineers in adopting the new processes. The rollout of these changes happened over 12 months, with engineering teams trained in waves every three months.

Throughout this transformation, the bank fostered a culture of continuous improvement. The tech teams regularly reviewed productivity data and looked for ways to increase efficiency. As a result, this bank achieved 30% more capacity in its tech team without expanding the budget.

2. Use Generative AI Across the Product Lifecycle

Generative AI (gen AI) tools have received a lot of attention for their potential to save time for engineering teams. Many banks are piloting these tools, which allow faster coding. But scaling these tools can be challenging. Banks often treat these pilots as standalone tools and overlook the need for broader organizational changes. Adoption is high among the first 100 users but slows afterward. Additionally, many AI tools focus on only part of the development process, like code generation, which is a small fraction of engineers’ work. Without customization, these tools may generate code that doesn’t align with company standards.

Some banks are taking a more holistic approach to implementing gen AI tools. They extend these tools to everyone involved in product development, not just coders. For instance, product owners can use gen AI to quickly generate feature stories and architecture diagrams—tasks that would otherwise take days. Recognizing the transformational impact of gen AI, these banks also invest in change management, ensuring these tools integrate into daily workflows. They fine-tune the tools with their code base and use various models for specific tasks, seeing productivity gains of 20-30% in development teams.

3. Integrate Tech and Business Teams

To improve tech productivity, banks often need to change how engineering and business teams work together. In many cases, moving from an idea to the start of coding takes several months due to approvals, funding, and other processes. While engineers can code quickly once requirements are clear, this delay affects productivity.

Taking cues from tech companies, some banks have created integrated teams of product managers and engineers, sometimes including operations as well. These teams operate like mini-businesses, with product managers working as team leads to align everyone toward shared quarterly goals. This structure reduces the need for formal requirement documents and change requests, which traditionally slow down product development. While digital and mobile teams often work in this way, many banks still use a project-focused model for other teams.

One large bank made this shift by reorganizing teams and establishing new roles and shared incentives, led by top executives. The bank replaced annual IT funding processes with quarterly business reviews and invested in extensive coaching for everyone from executives to developers. This move led to a 20-30% capacity increase and a stronger focus on customer experience.

4. Build Skilled, High-Performance Teams

Working in a fast-paced, productive tech environment often requires a different level of engineering talent. Leading banks are shifting from large teams of less-experienced contractors to smaller in-house teams of highly skilled engineers. Though these experts command higher salaries, their efficiency more than makes up for the increased cost and helps attract other high-caliber engineers.

Attracting top talent requires a different approach to recruitment and retention. One bank revamped its employment offer for tech roles by emphasizing the chance to impact millions of customers, work with advanced technology, and grow in a collaborative environment. IT and HR leaders introduced a streamlined career path, where engineers would receive promotions when ready instead of having to apply for new roles. They also created a talent accelerator with full-time HR and engineering staff to improve hiring standards and enhance onboarding experiences. This approach helped the bank transition from 70% external engineers to 70% internal ones within three years, boosting productivity, strengthening alignment between business and tech, and reducing turnover.

Making Productivity a Priority

Many banks are beginning to implement these strategies, recognizing that falling behind in tech productivity is not an option. However, some institutions struggle to see immediate results, often due to challenges in measuring baseline productivity, identifying the most impactful actions, or finding the time for transformation amid daily demands.

Banks that succeed in this transformation typically have strong support from the CEO and executive team. These banks meet five key prerequisites to ensure productivity-focused efforts take root:

- Bold Goals: Set ambitious, attainable goals by looking at success stories from other industries.

- Measurable Impact: Establish a productivity baseline and measure potential gains to guide high-ROI actions.

- Cross-Department Support: Engineering productivity must be a priority across both tech and business teams to ensure lasting change.

- Clear Leadership Accountability: Transforming engineering requires teamwork within the IT leadership. Designating a “first among equals” leader to steer the effort can drive coordinated actions.

- Early Wins: Early successes in areas important to the business build confidence and support for the transformation.

With these steps in place, banks can implement productivity changes at scale. Productivity-focused improvements often deliver noticeable impact quickly, as they typically don’t require lengthy processes like core platform overhauls. Banks that act boldly to increase their tech teams’ productivity can achieve more for their customers and their bottom line.

One Comment